Payroll Reconciliation Import Setup

Some minor enhancements have been made to the Payroll Reconciliation Import Setup process. Payroll Reconciliation Import Setup is accessed on the Import/Export tab of the Payroll Setup Form.

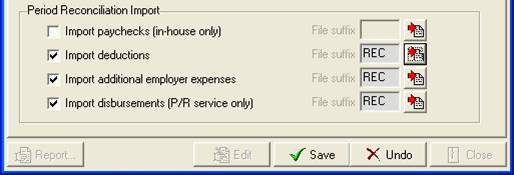

Period Reconciliation Import Setup

Reconciliation data consists of checks (employee pay checks), deductions, additional employer expenses, and payroll service disbursements. Deductions and Additional Employer Expenses, and payroll service disbursements are set up on the G/L tab of the Payroll Setup Form. There you can name your individual deductions/expenses/disbursements and associate them to your specific G/L Chart of Accounts.

Depending on your payroll service or external payroll system, you may have one or more reconciliation files provided that contain ‘amounts’ for checks, deductions, additional employer expenses, and payroll service disbursements. SuccessWare21 can be taught to import this information. Depending on the information available, you can tell SuccessWare21 what to import. Reconciliation data may be provided in different files. For each of these categories you want to import, you can setup the Import Filter by clicking the ‘import’ button next to each category.

Import Filter Setup

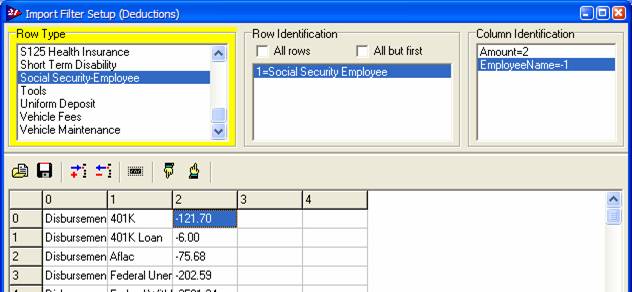

This process teaches SuccessWare21 how to import checks, deductions, additional employer expenses, and payroll service disbursements. There are two basic steps to this process.

1) Row Identification: Identify rows in the import report that correspond to your checks and individual deductions, additional employer expenses, and payroll service disbursements row types.

2) Column Identification: Identify the correct columns from which to ‘pull’ the data, typically the dollar ‘amount’.

The top of the Payroll Period Reconciliation Import Setup Form displays your individual row types, and for each row type the Row Identification and the Column Identification:

You can load a sample import file and it will be displayed as rows and columns in the grid.

In the example above, the deduction “Social Security-Employee” is identified by any row that has the value “Social Security Employee” in column 1. The ‘amount’ will be pulled from column 2. The ‘employee name’ will not be pulled and is not used. Note that when setting up checks (employee pay checks), employee name will be required.

Enhanced Grid Menu

The import file grid’s popup menu has been enhanced to simplify this process. Simply right clicking on a cell in the grid and the popup menu will provide you with all the features to set up the selected ‘row type’. The menu is divided into separate sections that all apply to the currently selected ‘row type’.

- If selected cell value is not already part of the current row identification, at the top of the menu you will see an option to add it to the row identification.

- Following this, each row identification entry for the current ‘row type’ will be listed along with an option to remove it.

- Next, the column identification for the current ‘row type’ will be listed. Use this section to identify what columns to pull data from (employee code and/or amount). Note, for checks, employee code will be required.

- Quick Tip: Once you have identified a column for a data item, you can set the same column value on all row types (by selecting “pull xxx from column x for all row types”).

- Last is the Save Setup option which will save any changes you have made.