SuccessWare®21 Agreements

|

Concept Guide |

Coverage—Maintenance

vs. Service

Agreement

Default G/L Accounts

Setting

Aside a Service Reserve

Initial

Sale—Activating the Agreement

Service

Charge to the Agreement

For

more information on using SuccessWare®21 Agreements, see the on-line

documentation or your training manual.

Agreement Management

Managing agreements within SuccessWare®21 consists of

· Setting up the agreement

· Agreement billing

o Initial sale—activating the agreement

o Periodic billing

o Per-visit billing

o Service charged to the agreement

Setting Up the Agreement

On-line help contains descriptions of the different parts of the agreement:

· Agreement information (agreement#; type; *coverage; *term; *dept; *visits/years; sale/start/end dates; *discount)

· Payment method

· *Billing information (*billing method: per visit, periodic, prepaid, no-charge; *periodic billing frequency)

· Equipment covered

· Visit schedule (for agreements covering maintenance)

*These parts of the agreement can be set up as agreement templates. Agreement templates can be associated with agreement types. When entering an agreement, when you select an agreement type, the template information associated with that agreement type is optionally loaded into the current agreement.

Coverage—Maintenance vs. Service

An agreement can cover maintenance and/or service work performed. Maintenance coverage consists of scheduled visits. Service coverage includes unexpected service calls.

· Maintenance revenue can be deferred.

· Service reserve can be set aside as a liability based on the service value of the agreement.

These deferrals and reserves originate from portions of the initial deposits on sales of agreements and the periodic billings of agreements based upon agreement billing information set up.

Term—Perpetual vs. Fixed

An agreement can be set up with either a fixed term or to run perpetually. A fixed term agreement will be in-effect from the start date to the end date. A perpetual agreement will be in effect from the start date indefinitely until the customer cancels the agreement. Perpetual agreements do not have an end date.

Billing Information

An agreement can be set up for billing in one of four methods:

· Per visit—the customer will be billed for each visit performed. (only with maintenance coverage)

· Periodic—the customer will be billed on a regular interval independent of when visits are performed.

· Prepaid—the customer will not be billed; the agreement is paid for in full, up front. (fixed term only)

· No-charge—the customer will not be billed, there is no charge for this agreement. (fixed term only)

Agreement Default G/L Accounts

Most line items on an invoice post to the G/L account set up on the items associated sales type. Agreement line items (initial sale, periodic billings, visits, service line items changed to agreements) always post to the agreement default G/L accounts. There are five default G/L account associated with agreement revenue:

· Agreement Revenue—recognized agreement revenue.

· Agreement Deferred Revenue—revenue to be recognized in the future (when maintenance visits are performed).

· Agreement Reserve—liability set aside for future service charged to the agreement.

· Agreement Expense—expense entries made in association with Agreement Reserve.

· Agreement Expense Excess— expense entries in excess of original reserve.

Deferring Maintenance Revenue

Agreements can be set up to defer revenue if they cover maintenance. When an agreement is set up to defer revenue, portions of billings posted for the agreement will post to the Agreement Deferred Revenue G/L account. Any amounts not deferred will post the Agreement Revenue account. This will happen when posting:

· The invoice for the initial sale of the agreement

· A periodic invoice for the agreement

This deferred revenue will be recognized later by debiting the Agreement Deferred Revenue account and crediting the Agreement Revenue account when posting invoices for visits performed.

To set up an agreement to defer maintenance revenue:

1) The agreement must cover ‘maintenance’ or ‘maintenance and service’.

2) The ‘defer revenue’ checkbox must be selected.

3) If any amount of the initial maintenance portion of the deposit is to be deferred, it must be specified as part of the billing information.

For agreements set up to defer maintenance revenue, the entire maintenance portion of periodic billings will be deferred.

Setting Aside a Service Reserve

Agreements can be set up to set aside a service reserve to

be used for future service charged to the agreement. When an agreement is set up to ‘use reserve’,

a liability is set up equal to service revenues posted during initial sale and

periodic billings by crediting Agreement Reserve and debiting Agreement

Expense.

This liability is then reversed, debiting Agreement Reserve and crediting Agreement Expense, when service line items are charged to the agreement.

To set up an agreement to set aside a reserve:

1) The agreement must cover ‘service’ or ‘maintenance and service’.

2) The ‘use reserve’ checkbox must be selected.

3) If any amount of the initial service portion of the deposit is to be reserved, it must be specified as part of the billing information.

For agreements set up to set aside service reserve, the entire service portion of periodic billings will create a reserve liability in addition to posting to the Agreement Revenue account.

Agreement Billing

Initial Sale—Activating the Agreement

To activate an agreement, the initial sale of the agreement

must be posted as a line item on a customer invoice. It is the posting of the invoice that

activates the agreement. When this

invoice is posted, the initial deposit set up on the agreement is posted. Any

maintenance portion of the deposit, set up to be deferred, posts to the Agreement

Deferred Revenue account instead of Agreement Revenue. The entire service amount of the deposit will

always be credited to the Agreement Revenue account. If any portion of the service amount of the

deposit is set up to be reserved, that portion will post to both the Agreement

Reserve liability account and the Agreement Expense account in

addition to hitting the Agreement Revenue account.

|

Initial

Agreement Sale |

Total

Deposit $200.00 |

Maintenance

$100 |

Deferred

portion $70 Balance

$30 |

(cr) Agreement Deferred Revenue (cr) Agreement Revenue |

|

|

|

Service

$100 |

Service

$100 Reserve

portion $25 Reserve portion

$25 |

(cr) Agreement Revenue (cr) Agreement Reserve (dr) Agreement Expense |

Note that when first implementing SuccessWare®21, pre-existing agreement are entered and activated by ‘converting’ and then ‘committing’ the agreement rather that posting the initial sale invoice. ‘Converted’ agreements allow you to identify the number of periodic billings and which visits were already completed prior to SuccessWare®21 implementation. ‘Committed’ agreements then behave the same as agreements activated by the posting of the initial sales invoice.

Periodic Billing

Periodic billing is billing performed on a regular interval. This billing may include both service and maintenance revenue. All of the maintenance revenue will post to the Agreement Deferred Revenue account if the agreement is set up to defer revenue, or, if it is not set up to defer revenue, the entire maintenance amount will post to the Agreement account. If the agreement is set up to reserve funds, the Agreement Reserve account will be credited and the Agreement Expense account will be debited in an amount equal to the service amount.

|

Periodic

Billing |

Total

Bill $71.50 |

Maintenance

$61.50 |

Maintenance

$61.50 Maintenance

$61.50 |

(cr) Agreement Deferred Revenue (if

deferred) (cr) Agreement Revenue (if not

deferred) |

|

|

|

Service

$10.00 |

Service

$10.00 Service

$10.00 Service

$10.00 |

(cr) Agreement Revenue (cr) Agreement Reserve (if ‘use

reserve’) (dr) Agreement Expense (if ‘use

reserve’) |

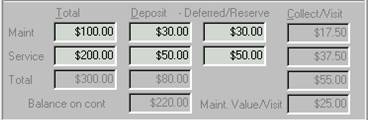

Per-Visit Billing

Per-visit billing involves the billing of a scheduled visit. The revenue amounts, maintenance and service, are predetermined based upon the agreement setup. Any maintenance amount previously deferred either from the initial deposit on the agreement or from periodic billings will now be recognized by debiting the Agreement Deferred Revenue account and crediting the Agreement Revenue account. Maintenance amounts not previously deferred are credited to the Agreement Revenue account.

The ‘maintenance value/visit’ is determined by dividing the annual maintenance value of the contract by the number of visits per year. The maintenance amount to collect/visit is the maintenance value per visit less the deposit amount per visit.

In this example, the contract includes 4 maintenance visit, 2 per year for 2 years. The maintenance value/visit is ($100 / 2 years) / 2 visits per year = $25.00.

The maintenance amount to collect/visit is $25 – (($30 / 2) / 2) or $25 - $7.50 = $17.50.

|

Per Visit

Billing |

Total

Bill $55.00 |

Maintenance

$25.00 |

Previously

deferred $7.50 Maint.

to-collect $17.50 |

(dr) Agreement Deferred Revenue (cr) Agreement Revenue |

|

|

|

Service

$37.50 |

Service

$37.50 Service

$37.50 Service

$37.50 |

(cr) Agreement Revenue (cr) Agreement Reserve (if ‘use

reserve’) (dr) Agreement Expense (if ‘use

reserve’) |

The service-to-collect amount is credited to the Agreement Revenue account. If the agreement is set up to reserve service revenue, the service-to-collect amount is also credited to the Agreement Reserve account and debited to the Agreement Expense Account. The service-to-collect amount is the difference between the annual service value of the contract and the amount of annual deposit divided by the total number of visits, (($200/2)-($50/2)) / 2 or ($100-$25) / 2 = $37.50.

Service Charge to the Agreement

Service work performed that is covered by the contract will be invoiced. These line items are charged to the agreement instead of receivables. When the agreement is set up to use service reserve, the service amount is debited to the Agreement Reserve account and credited to the Agreement Expense account. If the agreement’s reserve is depleted, any service amount in excess of the agreement’s reserve is still credited to the Agreement Expense Account, but debited to the Agreement Expense Excess account instead of the Agreement Reserve account. The Agreement Expense / Agreement Expense Excess entries are also made for any agreements are not set up to use service reserve.

|

Service

Charged |

Total

Bill $149.95 |

Service

$149.95 |

Service

$149.95 Service

$149.95 Service

$149.95 |

(dr) Agreement Reserve (if ‘use

reserve’) (cr) Agreement Expense (if ‘use

reserve’) (dr) Agreement Expense Excess (reserve

exceeded) |

Agreement Reporting

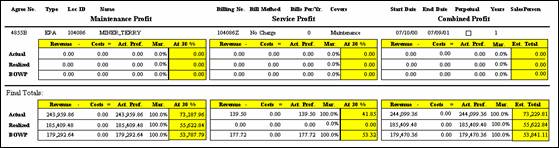

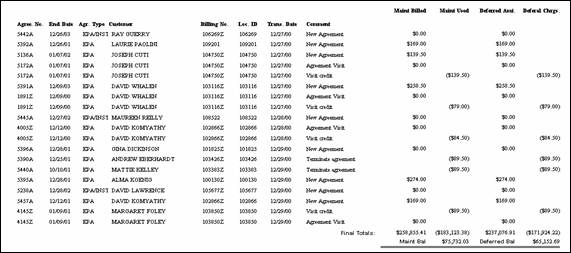

Deferral Analysis

Use the Deferral Analysis report to show the total maintenance billed and used (visits) vs. amounts deferred and recognized from deferred revenue for any selected date range. If all agreements are deferred the amounts billed and deferred will be the same.

Reserve Analysis

Use the Reserve Analysis report to show the total billed for service and used (charge to agreement) vs. amounts reserved and charged from agreement reserve for any selected date range. If all agreements covering service are using reserve, the amounts billed and reserved will be the same.

<no sample>

Agreement Profitability

Use the Agreement Profitability report to get an overall profit picture for your agreements for any selected date range. This report is based upon agreement related billings, and costs associated with agreement line items (invoice cost detail).